Compare your monthly payments and total cost between a 15 year and a 30 year mortgage

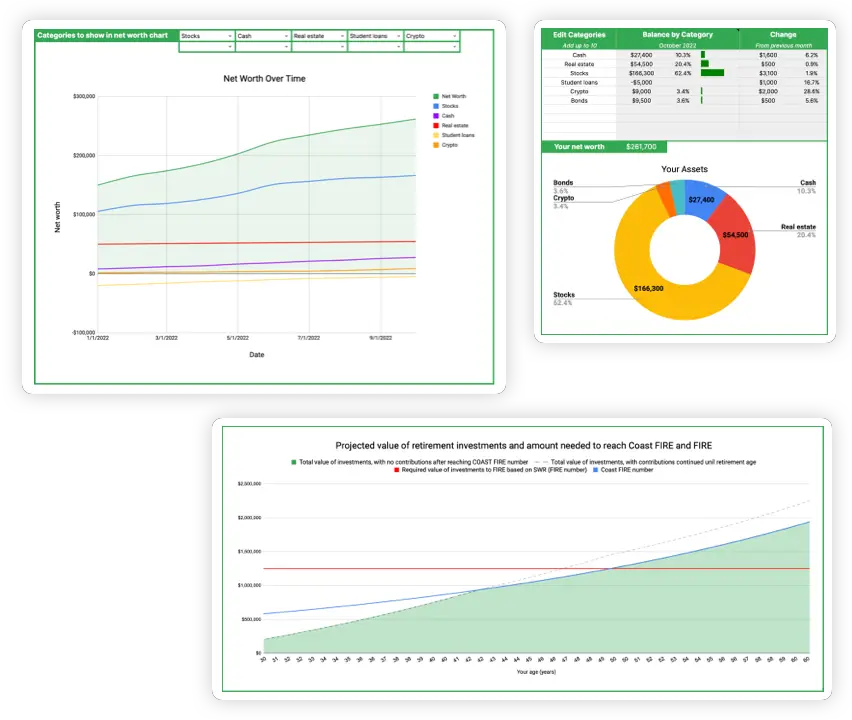

Take your wealth planning to the next level with my Wealth Planning Toolkit for Google Sheets – just $20.

Plan for recurring monthly income over different time periods as well as windfalls and one-time purchases in the future.

Includes 10 year Net Worth Tracker with Dashboard, Asset Rebalancing Calculator, and advanced FIRE and Coast FIRE Calculators.

Use the calculator above to input the details of your home purchase and compare the monthly payments and total cost of a 15 year fixed-rate mortgage versus a 30 year fixed-rate mortgage.

How to Use This Calculator

This calculator was designed to help you compare the monthly payments and total cost of a 15 year fixed-rate mortgage versus a 30 year fixed-rate mortgage. To use it, simply input your home purchase price, down payment percentage, and expected interest rate for each of the loan types. Then, the calculator will automatically update the monthly payments and interest numbers.

You can click on the 15 Year Loan Amortization Schedule or the 30 Year Loan Amortization Schedule tabs to view the breakdown of your payment towards principal and interest each month.

Overview of 15 Year Mortgage vs 30 Year Mortgage

Among the various types of mortgages, the 30 year and 15 year fixed rate mortgages are the most commonly used among borrowers purchasing a home. The 30 year fixed-rate mortgage is by far the most popular loan type and is used by about 90% of borrowers buying a home according to Freddie Mac’s 2016 home buyer statistics. In second place is the 15 year fixed-rate mortgage, which is used by only about 6% of borrowers buying a home.

The key difference between these two mortgage types is the duration of the loan – you pay off the same initial loan amount over a period of either 15 years or 30 years. Read on to learn about the pros and cons of each mortgage type, and which one may be best for you.

15 Year Mortgage

Pros:

With a 15 year mortgage, lenders usually offer a lower interest rate than 30 year loans. Since the duration of the loan is half that of the 30 year mortgage, you pay less interest over the course of loan, even if the interest rates were the same. These two factors combined mean that the total interest paid over the length of the 15 year mortgage is much less than the 30 year mortgage. A 15 year mortgage also allows you to own your home free and clear much faster than a 30 year mortgage.

Cons:

The downside with a 15 year mortgage is that it has a higher monthly payment than a 30 year mortgage.

Who is the 15 year mortgage good for?

A 15 year mortgage may make sense for you if you are sufficiently established in your career to afford the higher monthly payments and wish to pay off your home before reaching retirement.

30 Year Mortgage

Pros:

The advantage of a 30 year mortgage is that it has a much lower monthly payment than a 15 year mortgage. This can make becoming a homeowner achievable even if you do not have as high of an income. In addition, a lower monthly payment allows you to invest more in your income into assets like index funds which may have a higher average annual return than your mortgage rate. With most 30 year mortgages, you can make additional principal payments at your discretion to pay off your house sooner, but you still have the flexibility of the fixed lower monthly payment.

Cons:

The downside to a 30 year mortgage is that you pay much more total interest over the length of the loan, as you can see with this calculator. In addition, lenders typically offer a higher interest rate for 30 year loans, so this further contributes to the interest expense.

Who is the 30 year mortgage good for?

As its popularity shows, a 30 year mortgage is generally a good bet no matter your financial situation. It is more affordable on a monthly basis and provides better flexibility allowing you to pay off your home faster if you choose to do so.