Project how much your Health Savings Account (HSA) could grow over time

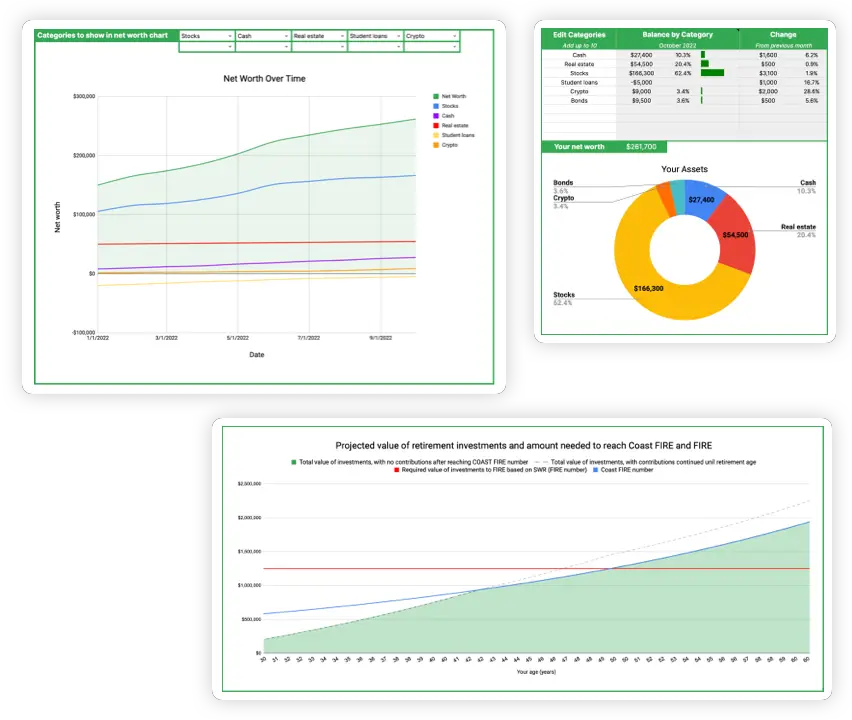

Take your wealth planning to the next level with my Wealth Planning Toolkit for Google Sheets – just $20.

Plan for recurring monthly income over different time periods as well as windfalls and one-time purchases in the future.

Includes 10 year Net Worth Tracker with Dashboard, Asset Rebalancing Calculator, and advanced FIRE and Coast FIRE Calculators.

What is an HSA, and how does it work?

A health savings account, or HSA for short, is a unique tax-advantaged savings account available only for people who are enrolled in a High Deductible Health Insurance Plan (HDHP).

Most HSAs allow you to invest your funds in the stock market right within your account, making them much more than a simple savings account.

Although it is intended as a savings account for health-related expenses, with some careful planning, your HSA can be used as your most versatile investment account to save for retirement.

The HSA triple tax advantage

What makes the HSA so special compared to other types of retirement accounts is that it is triple tax advantaged. This means that the contributions you make to your HSA are tax-free, your investments within your HSA can grow tax-free, and then you can take tax-free distributions from your HSA as long as you follow the IRS rules. While some popular retirement accounts like a traditional 401k or traditional IRA allow tax-free contributions, and others like the Roth 401k or Roth IRA offer tax-free growth and withdrawals (after age 59.5), the HSA is unique in that it is tax-free on both ends.

How to take full advantage of your HSA

Given the triple tax advantage of the HSA, it is well worth understanding how to maximize the tax benefits of your HSA.

While many people will simply use an HSA as a savings account that can be tapped into to pay for qualified medical expenses, the way to unlock the full potential of your HSA is to delay your HSA distributions, and invest your HSA funds into index funds right within your account.

Here’s how it works:

- As you incur medical expenses, you pay for them out-of-pocket and carefully track your receipts.

- Max out your HSA contribution every year, and invest your HSA funds into index funds right within your account.

- As long as your qualified medical expenses occur after your HSA was opened, you can take a withdrawal from the HSA at any time for the amount of your expenses to reimburse yourself.

Since there is no rule stating that you must directly pay for medical expenses with your HSA or reimburse yourself within a certain period of time after incurring the expense, it makes sense to delay reimbursing yourself as long as possible, even until your retirement, to allow your HSA investments to grow tax-free.

In this sense, your HSA becomes your ultimate investment vehicle for retirement.

In the (fortunate) case that you have limited medical expenses to enable withdrawing from your HSA, your HSA is treated like a traditional IRA but with a distribution age of 65 rather than 59.5. Your HSA investments can still grow tax-free, and you can withdraw money from your HSA for any expenses after age 65 without penalty. However, like a traditional IRA, you will need to pay taxes on distributions that aren’t for qualified medical expenses.

2024 HSA Contribution Limits

Each year, the IRS sets the annual contribution limits for HSAs. The amount you can contribute each year depends on if you are enrolled in a self-only health plan or a family plan, and if you are age 55 and older.

In 2024, the HSA contribution limit is $4,150 for self-only coverage, and $8,300 for family coverage. If you are age 55 or older, you can make an additional $1,000 catch-up contribution.

Some employers will provide employee HSA contributions to incentivize employees to chose High Deductible Health Plans which are usually lower-cost than traditional PPO plans. An employer HSA contribution does count towards the HSA contribution limits mentioned above.

Calculator Inputs

- Health Plan Type is the type of High Deductible Health Plan coverage that you are enrolled in. The two types of coverage are self-only and family

- HSA Starting Value is the initial value of your HSA account.

- Annual HSA Contribution is the total amount that you plan to contribute to your HSA each year, including your employer contributions. For 2024, the HSA contribution limit is $4,150 for self-only coverage, and $8,300 for family coverage. If you are age 55 or older, you can make an additional $1,000 catch-up contribution.

- Annual HSA Expenses is the amount of HSA reimbursements that you plan to take from your HSA each year to cover your medical expenses. The optimal approach is to keep that value at zero, even if you do have medical expenses over this time, and defer your reimbursements as far as possible into the future.

- Rate of return is the annual rate that the calculator will project your HSA account investments to grow.