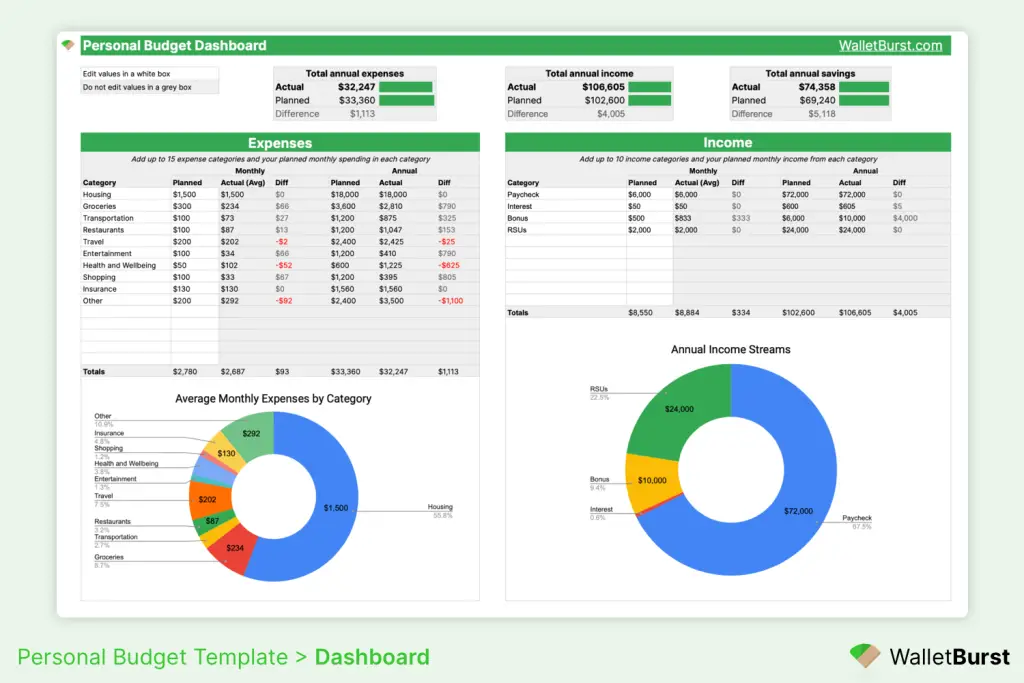

My personal budget template is the only tool you need to manage your monthly budget and track your day-to-day spending and income for the entire year.

It includes a dashboard and an income & expenses sheet for each month of the year. The dashboard automatically pulls all the transactions that you enter on each monthly income & expenses sheet.

On the dashboard, you can:

- Add up to 15 expense categories and enter your planned monthly spending in each category.

- Add up to 10 income categories and enter your estimated monthly income in each category.

- View your monthly income, expenses, and savings trends over the course of the year.

- View your average expenses over the entire year.

- View your monthly spending trends by category over the entire year.

- View your savings over the entire year.

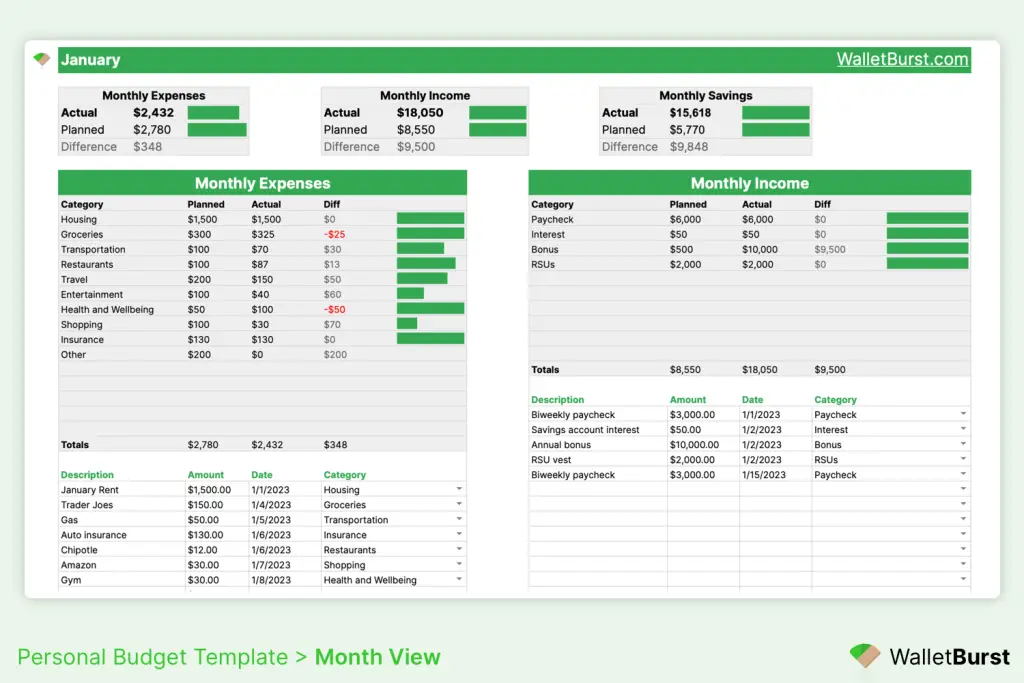

On each monthly income & expenses sheet, you can:

- Enter each of your transactions (expenses and income) for that month.

- Compare your actual versus planned monthly spending for each category.

- View your planned versus actual savings for that month.

How to download my personal budget template

- Go my Gumroad listing and click the I Want This button.

- On the next page, enter your email address and click Get. You will immediately receive an email from Gumroad.

- Click the Download Budget Template button in the email, and then on the Gumroad product page, click on the link to save the budget template to your Google Account.

- In the Google Sheets window, click the Make A Copy button. The personal budget template will then appear in your Google account.

How to use the budget template

- Start in the Dashboard by adding and editing up to 15 expense categories and your planned monthly spending in each category.

- Then, add up to 10 income categories and enter your estimated monthly income in each category.

- Next, navigate to the monthly Income & Expenses sheet by clicking on the tabs at the bottom with the correct month name.

- In the month sheet, add all of your expense transactions for the month in the Monthly Expenses panel and add all of your income transactions for the month in the Monthly Income panel. Make sure to choose a category from the dropdown for each transaction.

- As you add transactions, the dashboard will automatically update, including the pie charts for income and expenses.

- On the dashboard, you can scroll down to the Monthly spending for selected category chart and choose one of your spending categories from the dropdown. The chart will update and show your monthly spending for that category over the course of the year.

What is a budget?

A budget is simply a plan for your personal income, spending, and savings over time. With a budget, you typically divide your income and expenses into categories, set a planned monthly amount for that category, and then measure your transactions over time to compare your actual finances against what you planned.

The 50/30/20 budget is one of the most common percentage-based budgets. With this budgeting method, you target spending 50% of your after-tax income on needs, 30% on wants, and 20% on savings. On the Dashboard of this budget template, you can view the percentage breakdown of your average monthly spending by category to help follow the 50/30/20 rule.

The zero-based budget is another popular budgeting strategy. With a zero-based budget, every dollar you earn is assigned to a specific budget category, which should include savings like retirement savings or savings to build your emergency fund.

Importance of budgeting

No matter how much money you earn each month, making and following a monthly budget is absolutely essential to building financial security for you and your family. Your budget is your map on the road to financial freedom.

Having a budget is important because it helps you to:

- Save for long-term goals like buying a car, saving a down payment for a house, and eventually retiring.

- Eliminate unnecessary expenses by taking control of your spending.

- Understand your personal burn rate and build your emergency fund.

- Get out of debt.

- Relieve stress and sleep better at night knowing your finances are under control.

- Boost your savings rate so that you can reach financial independence sooner.

Benefits of using Google Sheets for managing your budget

Google Sheets is one of the most popular and powerful tools for managing your personal budget. Here are some of the top reasons to use Google Sheets for managing your monthly budget:

- Free. Unlike paying for a Microsoft Excel license, using the Google Sheets software is free! In addition, my monthly budgeting template itself is free, so there’s no need to pay a recurring monthly fee for a financial planning app.

- Secure. Once you make a copy of the template, your monthly budget is hosted on your private Google account and no one else has access. Plus there’s no need to connect your bank accounts to an app that could be hacked.

- Cloud-based. Google Sheets is a cloud-based web application, which means that it is accessed through your web browser with your Google account instead of locally on your device. Since it is cloud-based, your Google Sheets budget is automatically saved whenever you make a change, and you can access your budget from any device, allowing you to add transactions on the go from your phone. For couples or families, you can add collaborators on your budget so that your spouse or family member can view and edit it as well.